Income Tax Calculation Fy 2020-21 / Income Tax Slabs Calculation FY 2020-21 - Which Tax ...

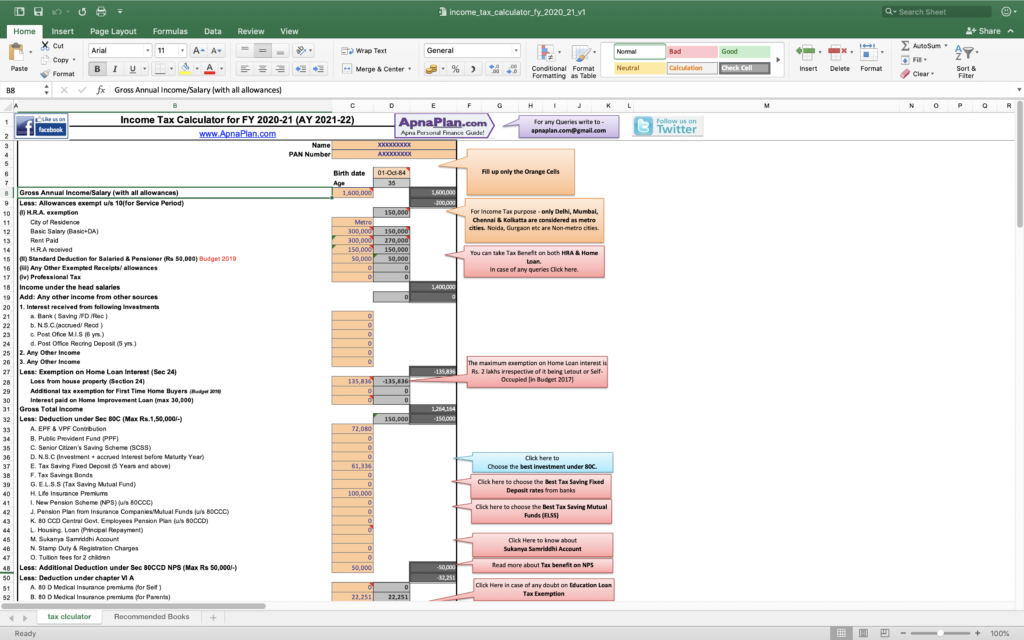

Do you know how much tax you need to pay for the year? This calculation is generated on the basis of the information provided and is for assistance only. Finding various tax saving instruments to save tax or reduce your tax liabilities. Income tax calculation is one of the complex tasks for the taxpayer. New tax regime best income tax saving options 2020. Learn how to use income tax calculator @ icici prulife. Personal income tax calculator excel calculate income from salary, pension, house property, interest, and dividend, etc.

An income tax calculator is a simple online tool which can help you calculate taxes payable on your income. Refer to the income tax provisions for the actual provisions all tax calculations (includes cess) are excluding surcharge & total eligible exemptions / deductions are assumed to be zero in new regime. Personal income tax calculator excel calculate income from salary, pension, house property, interest, and dividend, etc.

Income tax calculation is one of the complex tasks for the taxpayer.

New tax regime best income tax saving options 2020. Presently, taxpayers who are willing to opt for new tax. This calculator is only meant to provide a basic idea of the estimated impact of the new provisions. Learn how to use income tax calculator @ icici prulife. Pros & cons of new income tax structure. Income tax calculator is an online tool, which is specifically designed to help the taxpayers with their basic tax calculations. Use online tax calculator and fill required fields to the taxable income. The calculation of income tax that you are liable to pay under the new tax regime can be explained with an example. Finding various tax saving instruments to save tax or reduce your tax liabilities. Income tax slab for resident individuals aged less than 60 years(both male & female). Either to opt for the same tax rates which were applicable in last year or the. Should you use the new tax regime or continue with the old one? They sound rather similar, and many people.

Income tax calculator is an online tool, which is specifically designed to help the taxpayers with their basic tax calculations. Budget, budget 2020, calculator, income tax calculator. With the help of the income tax calculator, you can gauge the impact of both the tax structures on your income. Know which regime (old vs new) to opt for and why? Refer to the income tax provisions for the actual provisions all tax calculations (includes cess) are excluding surcharge & total eligible exemptions / deductions are assumed to be zero in new regime. Personal income tax calculator excel calculate income from salary, pension, house property, interest, and dividend, etc. Learn how to use income tax calculator @ icici prulife. Before you use the income tax calculator, you must know the difference between deduction and exemption. Before budget 2020, you had to only manage your taxes i.e. With the help of this will assist them with understanding, which charge framework might be better for them over the long haul.

Before budget 2020, you had to only manage your taxes i.e.

Before budget 2020, you had to only manage your taxes i.e. An income tax calculator is a simple online tool which can help you calculate taxes payable on your income. You will have to enter the gross income and deductions which you want to claim. The new regime of taxation is introduced which is optional to an. With the help of this will assist them with understanding, which charge framework might be better for them over the long haul. How to calculate income tax? Finding various tax saving instruments to save tax or reduce your tax liabilities. With the help of the income tax calculator, you can gauge the impact of both the tax structures on your income. Have you taken benefit of all tax saving rules and investments? Either to opt for the same tax rates which were applicable in last year or the. They sound rather similar, and many people.

This calculator is only meant to provide a basic idea of the estimated impact of the new provisions. In this new regime, taxpayers has an option to choose either : They sound rather similar, and many people. Before you use the income tax calculator, you must know the difference between deduction and exemption. With the help of the income tax calculator, you can gauge the impact of both the tax structures on your income. The calculation of income tax that you are liable to pay under the new tax regime can be explained with an example. Presently, taxpayers who are willing to opt for new tax.

Pros & cons of new income tax structure.

Updated with latest tax rates from indian #budget2020. Personal income tax calculator excel calculate income from salary, pension, house property, interest, and dividend, etc. An income tax calculator is a simple online tool which can help you calculate taxes payable on your income. With the help of the income tax calculator, you can gauge the impact of both the tax structures on your income. Income tax benefits rebate exemptions. Presently, taxpayers who are willing to opt for new tax. The calculation of income tax under the existing tax duty works in the same way. Refer to the income tax provisions for the actual provisions all tax calculations (includes cess) are excluding surcharge & total eligible exemptions / deductions are assumed to be zero in new regime. They sound rather similar, and many people. Use online tax calculator and fill required fields to the taxable income. To pay income tax at lower rates as per new tax regime on the condition that they forgo certain permissible exemptions and deductions available under. You will have to enter the gross income and deductions which you want to claim.

Before budget 2020, you had to only manage your taxes i.e.

Before budget 2020, you had to only manage your taxes i.e.

Income tax calculation is one of the complex tasks for the taxpayer.

Use online tax calculator and fill required fields to the taxable income.

Use online tax calculator and fill required fields to the taxable income.

Income tax calculator is an online tool, which is specifically designed to help the taxpayers with their basic tax calculations.

Have you taken benefit of all tax saving rules and investments?

Income tax benefits rebate exemptions.

Should you use the new tax regime or continue with the old one?

Finding various tax saving instruments to save tax or reduce your tax liabilities.

Presently, taxpayers who are willing to opt for new tax.

Have you taken benefit of all tax saving rules and investments?

To pay income tax at lower rates as per new tax regime on the condition that they forgo certain permissible exemptions and deductions available under.

With the help of this will assist them with understanding, which charge framework might be better for them over the long haul.

Presently, taxpayers who are willing to opt for new tax.

The new income tax calculations were announced with the new budget on 1st february by fm sitharaman.

The new income tax calculations were announced with the new budget on 1st february by fm sitharaman.

Before budget 2020, you had to only manage your taxes i.e.

Before budget 2020, you had to only manage your taxes i.e.

Do you know how much tax you need to pay for the year?

The new regime of taxation is introduced which is optional to an.

Either to opt for the same tax rates which were applicable in last year or the.

Pros & cons of new income tax structure.

The calculation of income tax that you are liable to pay under the new tax regime can be explained with an example.

The new income tax calculations were announced with the new budget on 1st february by fm sitharaman.

Watch full video to understand how income tax will be calculated using old and new income tax slab rates.

This calculation is generated on the basis of the information provided and is for assistance only.

Either to opt for the same tax rates which were applicable in last year or the.

With the help of this will assist them with understanding, which charge framework might be better for them over the long haul.

Either to opt for the same tax rates which were applicable in last year or the.

With the help of this will assist them with understanding, which charge framework might be better for them over the long haul.

Know which regime (old vs new) to opt for and why?

Posting Komentar untuk "Income Tax Calculation Fy 2020-21 / Income Tax Slabs Calculation FY 2020-21 - Which Tax ..."